Madhyam | 30 July 2014

The era of mega-arbitration: International court rules against Russia in $50 billion decision

BY KAVALJIT SINGH

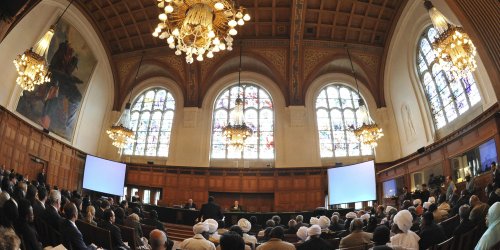

On July 28, 2014, an international arbitration tribunal under the auspices of the Permanent Court of Arbitration (The Hague) announced that Russia must pay $50.02 billion (Rs.300120 crore) in damages to former shareholders of the now defunct oil giant, Yukos Oil Company. The three-member tribunal unanimously declared that Russia breached its obligations under Article 13(1) of the Energy Charter Treaty when it “took steps equivalent to expropriation of the claimants’ investment in Yukos.”

In its Award, the tribunal said, “Yukos was the object of a series of politically motivated attacks by the Russian authorities that eventually led to its destruction…The primary objective of the Russian Federation was not to collect taxes but rather to bankrupt Yukos and appropriate its valuable assets.” The Russian authorities, on the other hand, maintain that its actions against Yukos were legitimate to tackle large-scale tax evasion and fraud committed by company’s owners and top management.

The three-member arbitral tribunal consisted of Yves Fortier (Chairman), Charles Poncet (appointed by shareholders of Yukos) and Judge Stephen Schwebel (appointed by Russia). Incidentally, Yves Fortier is Vodafone’s arbitrator in the upcoming international arbitration related to its long-running $2.4 bn tax dispute with the Indian government.

The international arbitration was initiated in 2005 by former majority shareholders of Yukos under the framework of Energy Charter Treaty – a multilateral treaty dealing with cross-border investments and trade in energy sector. Three separate lawsuits against were filed by former shareholders of Yukos (Yukos Universal Limited v. The Russian Federation, Hulley Enterprises Limited v. The Russian Federation, and Veteran Petroleum Limited v. The Russian Federation) seeking a total claim of $114 bn. The arbitration was conducted under the UNCITRAL rules.

The full text of the Final Award is available here.

The Biggest Award

The compensation amount of $50 bn is the largest international arbitration award to date. It is more than 20 times bigger than the previous record of $2.4 bn Award won by Dow Chemical Company against the Petrochemical Industries Company of Kuwait in 2013.

In relative terms, the compensation award is equivalent to around 11 per cent of Russia’s foreign exchange reserves, 10 per cent of annual national budget and 2.5 per cent of country’s GDP. Given the magnitude of compensation, the Award could be more damaging to the Russian economy than all the economic sanctions imposed by the West against Russia for its actions in Ukraine.

What is most astonishing is that the arbitral tribunal has not provided any standard or credible rationale behind awarding $50 bn in compensation to claimants. The calculations of total damages put forward by claimants are based on assumptions and hard evidence is lacking. The tribunal found that the claimants contributed to 25 per cent “to the prejudice they suffered at the hands of the Russian Federation.” Hence, the amount of damages to be paid by Russia is reduced by 25 per cent to $50 bn from $67 bn. In its lengthy 615-page verdict, no explanation has been given by the tribunal on how did it arrive at 25 per cent of claimants’ contributory fault? Why not 30 or 40 or 50 per cent?

The tribunal has given 180 days, until January 15, 2015, to Russia to pay $50 bn to shareholders. After that, interest would start accruing. The tribunal has also ordered Russia to pay $60 million in legal costs to claimants.

Separately, the European Court of Human Rights in Strasbourg is expected to announce this week its ruling on the case filed by the former management of Yukos.

The Oligarchs: The Biggest Beneficiaries of Tribunal Award

The single biggest beneficiary of the $50 bn award is Leonid Nevzlin, who currently owns more than 70 percent of GML – the Gibraltar-registered holding company through which Mikhail Khodorkovsky (Yukos’s former owner) held his controlling stake in the company.

After his arrest in 2003, Mikhail Khodorkovsky handed over his dominant share to Mr. Nevzlin, a Russian national who fled to Israel in 2003 after facing criminal charges in Russia. The other four major beneficiaries are also Russian nationals (living abroad) who own the rest 30 per cent stake in the GML. The tribunal has awarded a compensation of $39.97 bn to Hulley Enterprises, $1.84 bn to Yukos Universal and $8.2 bn for Veteran Petroleum Limited. Hulley Enterprises and Yukos Universal are wholly-owned subsidiaries of the GML. The Veteran Petroleum Limited looks after the interest of former employees of Yukos.

In other words, just five non-resident Russians who own the GML will together receive as much as $41.8 bn in compensation from the Russian government for the alleged violation of a multilateral treaty.

The Rise of Russian Oligarchs

No discussion on this complicated matter with legal as well as political overtones would be complete without understanding the rise of Russian oligarchs and the investment protection provisions of ECT (discussed later in this article).

It is a well-known fact that a handful of oligarchs control a disproportionate portion of the Russian economy since the early 1990s. By seizing assets and property at throwaway prices through corrupt means, relatively unknown individuals became billionaire oligarchs almost overnight during Russia’s transition to a market-based economy. Apart from generous support from corrupt, but elected, politicians, the empires of the Russian oligarchs were also built with the assistance of IMF and Western powers which played an important role in the privatization of assets and infrastructure built during the Soviet era.

Under the “loans for shares” program launched by President Boris Yeltsin, Mikhail Khodorkovsky’s Bank Menatep acquired control over Yukos in 1995. The Russian authorities claim that Bank Menatep rigged the auction process by blocking rival bidders and bought 78 per cent stake in Yukos (estimated to be worth about $5 bn) at the astoundingly low price of $310 million.

The Abuse of Transfer Pricing

After taking control over Yukos, Khodorkovsky (and his business associates) carried out massive financial engineering to reduce tax liabilities of the oil company. They used shell companies registered in offshore tax havens (such as Gibraltar, Cyprus, Isle of Man and Switzerland) to transfer highly profitable operations in such low-tax jurisdictions. Under this arrangement, Yukos will sell crude oil to these offshore shell companies (with no assets or employees) at below-market rates and the shell companies would sell oil to domestic and foreign buyers at market rates. Through such manipulative transfer pricing strategies, Yukos avoided paying taxes in Russia while the shell companies earned the bulk of profit. The shell companies were wholly owned by Khodorkovsky and his close business associates.

However, the rules of the game changed when Vladimir Putin was elected President in 2000 and one of his first steps was to crack down on tax evasion by big firms owned by oligarchs.

The Timeline of Yukos Saga (2003-2014)

October 2003: Mikhail Khodorkovsky is arrested on charges of massive tax evasion and fraud.

April 2004: Yukos is hit with a bill for $3.5 bn for tax allegedly unpaid in 2000. The Russian government freezes its assets.

November 2014: The Russian tax authorities examine the accounts of Yukos for the year 2002 and issue another multi-billion-dollar tax bill. All top executives of Yukos leave Russia, fearing imminent arrest.

December 2004: Russia auctions Yuganskneftegas, Yukos’s main production unit, which is later sold for $9.3 bn.

May 2005: Khodorkovsky is convicted of fraud and sentenced to nine years in prison.

2006-2007: Russia declares Yukos bankrupt and sells its remaining assets to Rosneft.

November 2009: An arbitral tribunal constituted under the auspices of the Permanent Court of Arbitration decides that Russia is bound by the ECT and the claims by majority shareholders are admissible under the Treaty.

October-November 2012: The arbitration case is tried over five weeks at the Permanent Court of Arbitration in The Hague.

December 2013: Khodorkovsky is pardoned by President Putin and released after a decade in custody.

July 2014: The arbitral tribunal gives a Final Award of $50 bn to the majority shareholders of Yukos.

What is Energy Charter Treaty?

ECT is a unique multilateral treaty aimed at the promotion of inter-governmental cooperation in the energy sector. The Treaty was signed in December 1994 and entered into force in April 1998. This legally-binding framework is signed or ratified by 54 countries, majority of them are from Europe.

It needs to be emphasized here that Russia only accepted the provisional application of the ECT (pending ratification) in 1994 meaning that the country will only apply the Treaty “to the extent that such provisional application is not inconsistent with its constitution, law or regulations.” Same was the approach adopted by Belarus, Iceland, Norway and Australia.

Russia never ratified the ECT and announced its decision to not become a Contracting Party to it on August 20, 2009. As per the procedures laid down in the Treaty, Russia officially withdrew from the ECT with effect from October 19, 2009.

Nevertheless, Russia is bound by its commitments under the ECT till October 19, 2029 because of Article 45 (3) (b) states that “In the event that a signatory terminates provisional application…any Investments made in its Area during such provisional application by Investors of other signatories shall nevertheless remain in effect with respect to those Investments for twenty years following the effective date of termination.”

ECT and Investment Protection

The ECT provides comprehensive rules related to protection of foreign investments in the energy sector including protection against unlawful expropriation, fair and equal treatment, most-favored nation, national treatment and umbrella clauses.

As in the case of NAFTA and bilateral investment treaties (BITs), ECT also contains investor-state dispute settlement provisions, in addition to state-to-state dispute resolution mechanisms. The ECT grants the right to foreign investors to take member-states to international arbitration if they feel that the treaty provisions (except those related to competition and environment) have been breached by the member-states.

Under the rules outlined in Article 26 (4), a private investor can choose to submit the dispute for resolution between three alternative arbitration institutions/rules: the International Centre for Settlement of Investment Disputes (ICSID) or the ICSID Additional Facility; the Arbitration Rules of the United Nations Commission on International Trade Law (UNCITRAL Rules); or the Arbitration Institute of the Stockholm Chamber of Commerce.

Till now, more than 30 cases have been brought by private investors to international arbitration under the ECT. Nils Eliasson, a legal expert, has analyzed arbitration cases filed under the ECT during 2001-11. He found that investors prefer to initiate arbitration under the ECT rather than under bilateral investment treaties.

Expropriation under the ECT

The ECT provides protection against not merely outright nationalization by the member-states but also against measures having effect equivalent to nationalization or expropriation that may also include regulatory and tax policies affecting the investment. The Article 13 (1) of the ECT clearly states:

“Investments of Investors of a Contracting Party in the Area of any other Contracting Party shall not be nationalized, expropriated or subjected to a measure or measures having effect equivalent to nationalization or expropriation (hereinafter referred to as “Expropriation”) except where such Expropriation is: (a) for a purpose which is in the public interest; (b) not discriminatory; (c) carried out under due process of law; and (d) accompanied by the payment of prompt, adequate and effective compensation. Such compensation shall amount to the fair market value of the Investment expropriated at the time immediately before the Expropriation or impending Expropriation became known in such a way as to affect the value of the Investment (hereinafter referred to as the “Valuation Date”).”

“Such fair market value shall at the request of the Investor be expressed in a Freely Convertible Currency on the basis of the market rate of exchange existing for that currency on the Valuation Date. Compensation shall also include interest at a commercial rate established on a market basis from the date of Expropriation until the date of payment.”

Is Tribunal Award Final and Binding?

As per the rules outlined in the Treaty, the awards of arbitration are final and binding on all parties related to the investment dispute. According to the Article 26 (8) of the ECT, “The awards of arbitration, which may include an award of interest, shall be final and binding upon the parties to the dispute. An award of arbitration concerning a measure of a sub-national government or authority of the disputing Contracting Party shall provide that the Contracting Party may pay monetary damages in lieu of any other remedy granted. Each Contracting Party shall carry out without delay any such award and shall make provision for the effective enforcement in its Area of such awards.”

Although the tribunal ruling is final and cannot be appealed at the Permanent Court of Arbitration, the Russian authorities could contest the decision of the arbitral tribunal in other legal forums (such as Dutch courts).

Initially thrilled with the tribunal’s decision, the GML and other shareholders will soon find it extremely difficult to enforce the Award as Russia has already decided to challenge it. The shareholders could seek to seize commercial assets of Russia (owned by country’s state-owned corporations and sovereign wealth funds) in 149 countries which are signatory to the United Nations Convention on the Recognition and Enforcement of Foreign Arbitral Award (popularly known the New York Convention).

In any case, it is going to be a time-consuming and uphill process to enforce the tribunal Award in 149 contracting parties of New York Convention.

Balancing Investors’ Rights with State Regulatory Actions in the Public Interest

Even though this Award is related to ECT, it provides important policy lessons to other countries which have already signed or currently negotiating bilateral investment treaties (that allow investor-to-state arbitration- ISA) without any consideration of consequences and potential costs.

At the global level, the growing proliferation of investor-state disputes highlights the lack of balance between public rights and private interests in the existing international investment treaty regime. There are currently more than 3000 BITs in force. The private investors could seek compensation worth billions of dollars from states for breaches of treaty obligations. But, at the same time, the states have the right to enact and enforce regulations related to taxation, financial stability, public health and environment, as part of exercising their sovereign powers.

The existing investment protection agreements have failed to address the balance of rights and responsibilities of foreign investors as it offers numerous legal rights for investors without requiring corresponding responsibilities for them.

Some years back, Venezuela and Ecuador had denunciated some of their BITs. Of late, many developing countries (including South Africa, India and Indonesia) are rethinking about the costs and benefits of BITs and are taking various policy measures to protect themselves from costly investor-state arbitration. Not surprisingly, the inclusion of investor-state arbitration in the ongoing negotiations over the Transatlantic Trade and Investment Partnership (TTIP) is hotly debated.

Apart from ISA, there are numerous problematic provisions of investment protection contained in existing bilateral and regional investment treaties that need a complete re-examination in the light of recent developments.